Gift of Business Interests

An Entrepreneurial Way to Make a Difference

As an entrepreneur, you can grow your business and also accomplish your ministry goals. Gifts of business interests, like stock in a closely held corporation or shares in an investment partnership, can provide you with tax and income benefits and further the ministry of Forest Home.

Have you created

a Will or Trust?

Forest Home has teamed up with Christian Trustmaker to provide this

free service.

free service.

Find out more by clicking

the green button below.

the green button below.

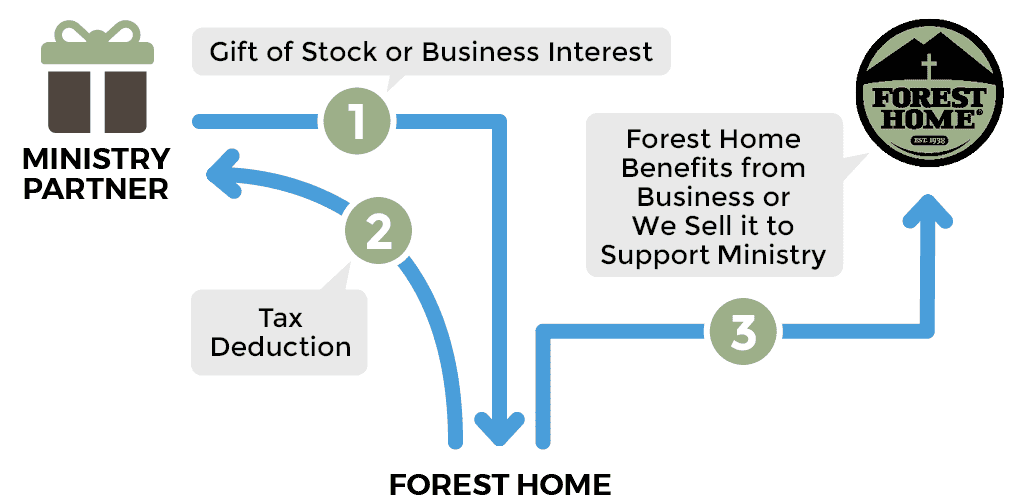

How It Works

- You give stock or business interest to Forest Home.

- You receive a tax deduction and avoid tax on the transfer of your stock or business interest.

- Forest Home receives income distributions or may sell shares to a third party.

Benefits

- You receive a charitable income tax deduction for your gift based on appraised value of your shares

- You pay no capital gains tax on any appreciation transferred to Forest Home.

- Gifts are usually made outright, but in some cases may be used to fund a life-income arrangement

- You experience the joy of making it possible for children, youth and families to experience the life-changing power of the Gospel at Forest Home without using cash reserves

A Gift of Business Interest May Be for You If:

- You are a business owner, entrepreneur, or an investor

- You are able to transfer your business interest to third parties like Forest Home

- You want to save both income and capital gains tax

- Your business interest will continue to generate income that can flow to Forest Home, or it is likely to be purchased or redeemed in the near future

- Your business interest is not encumbered by debt, and Forest Home will not be called on to make future contributions for the business

More Information

- You will need to check on whether there are any restrictions on the transferability of the shares, and that the shares have not been used to secure a loan from the corporation or partnership. If a loan is still outstanding, the IRS will consider the business interest gift as debt relief and will impute taxable income on the loan

- You will need to secure an independent appraisal of the fair market value of the business interest donation since shares in a closely held business or an investment partnership are not publicly traded

- Shares of an S-corporation are subject to additional IRS regulations

- Forest Home must first review and approve any transfer with regard to issues of marketability, liability and involvement in business operations