Gifts Through Your IRA

Make a tax-free distribution from your IRA

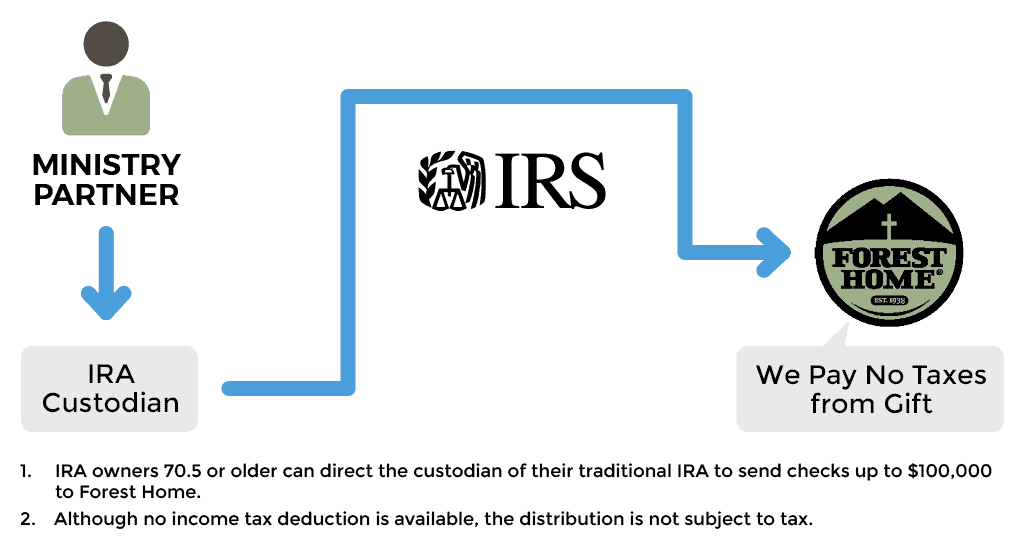

If you are 70½ or older, you can make a tax-free distribution from your IRA to Forest Home. You can give up to $100,000 each year without incurring income tax on your withdrawal. An IRA Charitable Rollover can be an efficient way to support Forest Home.

Have you created

a Will or Trust?

Forest Home has teamed up with Christian Trustmaker to provide this

free service.

free service.

Find out more by clicking

the green button below.

the green button below.

How It Works

- You direct distributions up to $100,000 from your IRA Custodian to Forest Home.

- The distributions go directly to Forest Home and generates neither taxable income nor a tax deduction.

Benefits

- You avoid taxes on the distribution up to $100,000

- You can satisfy your required minimum distribution for the year

- You reduce your taxable income even if you do not itemize charitable deductions

- You can potentially reduce the cost of your Medicare premiums

- Your gift is not subject to the 60% deduction limits on charitable gifts

- You experience the joy of making it possible for children, youth and families to experience the life-changing power of the Gospel at Forest Home

A Gift Through Your IRA May Be for You If:

- You are over age 70½

- You do not need the additional income from your required minimum distributions

- You don’t itemize deductions or your charitable deductions are limited

- You want to give more than the 60% charitable deduction limitation

- You live in a state with no charitable income tax deduction