Life Insurance Can Multiply Your Future Impact

You can name Forest Home as primary or contingent beneficiary of your life insurance policy. You can also donate an existing or new life insurance policy.

Have you created

a Will or Trust?

Forest Home has teamed up with Christian Trustmaker to provide this

free service.

free service.

Find out more by clicking

the green button below.

the green button below.

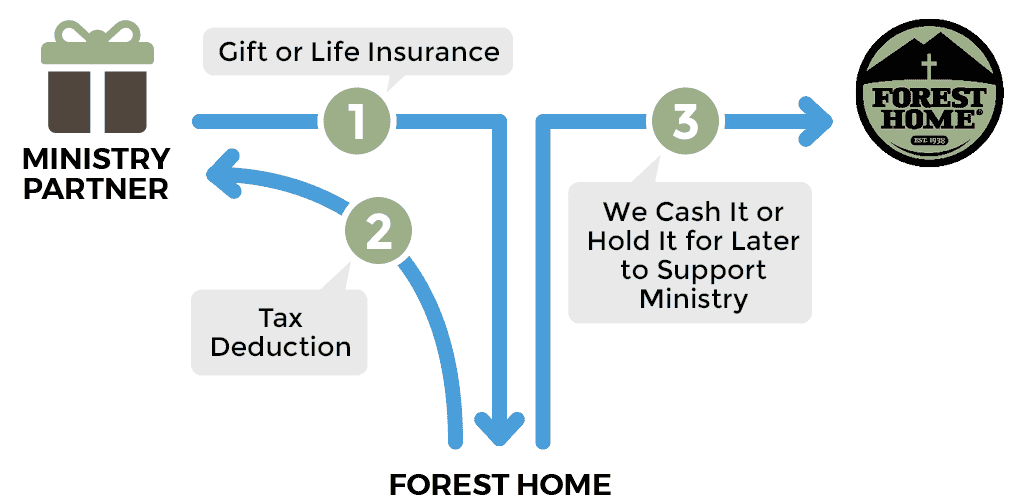

How It Works

- You can provide now for a significant future gift by naming Forest Home as beneficiary of an insurance policy, or you can give a new or existing life insurance policy

- If you contribute a new or existing life insurance policy, you can receive a charitable tax deduction

- Forest Home will either cash in the policy, or more likely, when the policy matures, the benefits will pass to Forest Home tax-free

Benefits

- You can make a significant gift in the future with less expense today

- You can designate Forest Home as a beneficiary with little paperwork and change your mind at any time

- You can give a new or existing life insurance policy and receive an income tax deduction

- You can receive additional tax deductions by making annual gifts so we can pay the policy premiums

- You could save taxes in the future by removing the insurance from your gross taxable estate

- You can experience the joy of making it possible for children, youth and families to experience the life-changing power of the Gospel at Forest Home for generations to come

A Life Insurance Gift May Be For You If:

- You are a younger donor who wants to make a significant gift in the future

- You have a life insurance policy that is no longer needed for dependent family

More Information

- For you to receive a charitable tax deduction for a life insurance policy, Forest Home has to be the irrevocable owner of the policy and not just its beneficiary

- A gift of a life insurance policy with a loan still outstanding will create taxable income for you in the amount of the loan balance